Navigating Travel insurance Coverage versus International Health Insurance

Traveling the globe as a nomad or frequent explorer has countless rewards and unique risks. So, how do you go about navigating travel insurance coverage?

The right insurance, whether lost luggage, a delayed flight, or a medical emergency in a remote location, is essential. However, the terms “travel insurance” and “nomadic health insurance” often get used interchangeably, leading to confusion. Here’s a guide to understanding the differences, common misconceptions, pitfalls, and how to choose the right option for your journey.

QUICK NOTE: This post contains affiliate links and Two Traveling After One may receive a commission for purchases made through these links, at no extra cost to you.

Table of Contents

What Is Travel Insurance?

Travel insurance is a short-term policy designed to cover specific risks while traveling, typically for trips lasting from a few days to a few months.

What It Covers:

- Trip Protection: Reimbursement for canceled, interrupted, or delayed trips.

- Baggage Issues: Compensation for lost, stolen, or delayed luggage.

- Emergency Medical Coverage: Limited coverage for injuries or illnesses incurred while traveling, often with evacuation services.

What It Doesn’t Cover:

- Ongoing medical care or pre-existing conditions (unless specified by the policy).

- Long-term health needs or routine doctor visits.

Pitfalls:

- Some policies require upfront payment for medical emergencies before reimbursement.

- Coverage is typically limited to the duration of a single trip.

Best For:

- Short vacations, work trips, or holidays where trip-related issues are the primary concern.

Check Out Our Latest Videos!

What Is Nomadic Health Insurance?

Nomadic or international health insurance provides long-term global health coverage designed for expats, digital nomads, and long-term travelers.

What It Covers:

- Routine and emergency medical care globally, including doctor visits, prescriptions, and hospital stays.

- Chronic condition management and sometimes dental or vision care (depending on the plan).

- Coverage within multiple countries, often including your home country.

What It Doesn’t Cover:

- Trip-related issues like cancellations, delays, or baggage problems.

- Adventure or extreme sports coverage (unless explicitly included).

Pitfalls:

- It may exclude high-risk countries or regions.

- It can be more expensive, depending on age and coverage level.

Best For:

- Digital nomads, retirees living abroad, and long-term travelers focused on comprehensive health care over trip-specific risks.

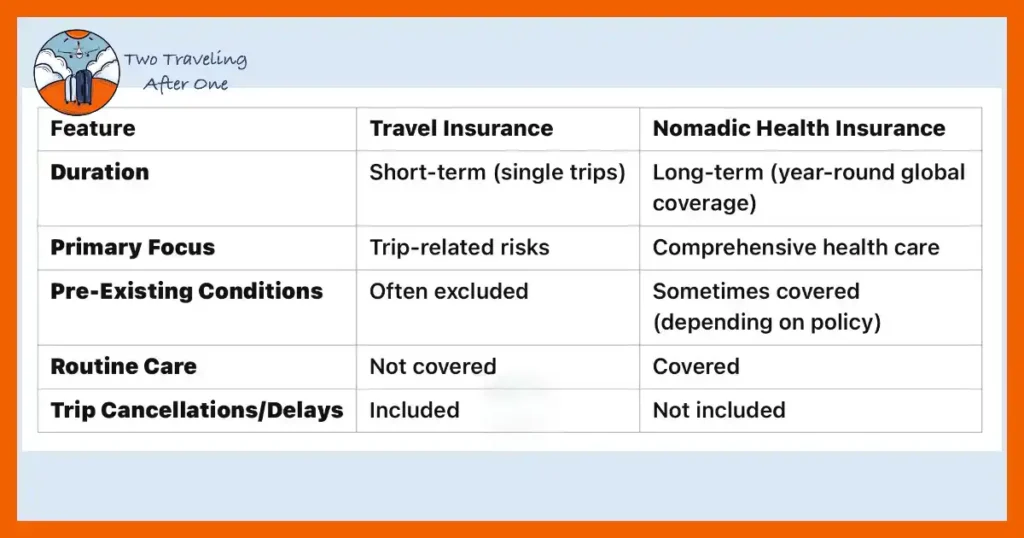

Key Differences Between Travel Insurance and Nomadic Health Insurance

Navigating Travel Insurance Coverage: Common Misconceptions

“Travel insurance covers everything.”

Many travelers assume travel insurance includes full health care coverage, but it’s limited to emergencies during a trip. Routine care or chronic condition management isn’t included.

“I don’t need health insurance if I have travel insurance.”

While travel insurance might cover emergency medical treatment, it won’t protect you for long-term health needs, especially for ongoing conditions.

“Nomadic health insurance includes trip cancellations.”

Health-focused plans rarely cover travel-related interruptions like lost luggage or delays.

Pitfalls to Avoid

- Skipping the Fine Print: Both types of policies have exclusions—always read the terms carefully.

- Not Disclosing Pre-Existing Conditions: This can lead to denied claims when you most need coverage.

- Overlapping Policies: Purchasing both types of insurance without understanding the overlap can waste money.

How to Choose the Right Insurance

- Assess Your Needs:

-

- Are you taking a short trip or traveling long-term?

- Do you need coverage for trip interruptions or comprehensive health care?

- Know Your Risk:

-

- For extreme sports or adventure travel, ensure your policy covers these activities.

- Compare Providers:

-

- Consider companies like American Express, Allianz, World Nomads, or AIG for travel insurance.

- Consider Cigna Global, Genki, SafetyWing, Allianz, or GeoBlue for nomadic health insurance.

- Understand Local Health Care Options (They May Cost You Less):

-

- Some countries have affordable, quality healthcare systems that might reduce your reliance on private insurance.

Our Recommendation

Stick with travel insurance to cover trip-related risks and emergencies for short trips or vacations. For long-term nomadic life, nomadic health insurance is essential for peace of mind and ongoing medical care. And if your lifestyle falls somewhere in between, consider combining both, but only if it makes financial sense.

Having the right coverage ensures you can focus on your adventures while staying protected. After all, the best journeys are worry-free!